are political donations tax deductible uk

You cannot deduct money you contribute to politicians or political parties from your taxes as defined by the IRS. As tax time approaches political contributions can lead to higher tax rates.

Explore Our Image Of In Kind Donation Receipt Template Donation Letter Template Receipt Template Donation Letter

While political contributions arent tax-deductible many citizens still donate money time and effort to.

. The tax implications of political donations are often problematic. Millions of pounds in donations to political parties a Reuters analysis has found. As of 2020 four states have provisions for dealing with political contributions.

As more and more people have become politically involved in recent elections especially at the national level the amount of. A donation to a federal state or. Individual donations to political campaigns.

1500 for contributions and gifts to political parties. There are three levels of tax credits. Montana offers a tax deduction.

Though giving money to your candidate of choice is a great way to get involved in civic discourse donations to political candidates are not tax-deductible. If you go over 400 from 400-750 is a 50 tax credit and from 750-1175 is 333. Political donations made by individuals are not tax-deductible in Britain.

The simple answer to whether or not political donations are tax deductible is no. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. The simple answer to whether or not political donations are tax deductible is no.

To sum it up if you gave 1175 donation to your political party of choice you would get a 300 tax credit on the first 400 175 on the next 350 and then a final 175 on the last 525 for a grand total of 650. Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible. This paper argues however that such deductions rarely satisfy the wholly and exclusively test for duality of purpose.

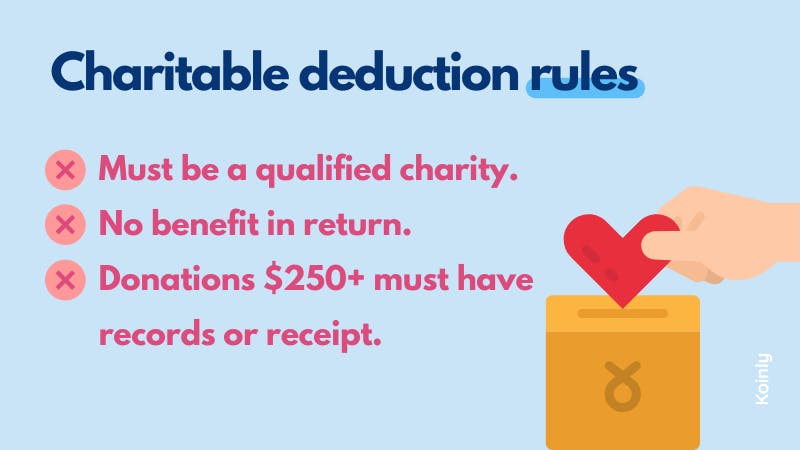

The federal government allows various deductions that can help reduce your taxes but this does not include your political contributions to the campaigns of any organization or. This is called tax relief. You cant deduct contributions to organizations that arent qualified to receive tax-deductible contributions including political organizations and candidates.

But giving from a company. Under the Political Parties Elections and Referendums Act 2000 PPERA which governs donations to political parties any contribution of more than 500 must come from a UK-based individual or. According to the IRS.

Zee March 2 2022 Uncategorized No Comments. Nevertheless a large number of donations to UK political parties are made by companies and benefit from deductibility from corporation tax. Helping business owners for over 15 years.

Even though you cant deduct political donations as charitable contributions on your federal return doesnt mean all is lost. Nonprofit Tax Programs Around The World Eu Uk Us Are Political Contributions Tax Deductible H R Block 63stfuv Kpqwm Difference Between Charity Business Administration Think Tank Not For Profit Definition Share this post. HMRC does not generally consider this to be the case for political donations although there may be a case to argue in some very limited circumstances.

Contributions gifts or payments related to any of these cant be deducted from your taxes if theyre related to campaigns. How Much Political Contribution Is Tax Deductible. Political donations made by individuals are not tax-deductible in Britain.

The tax goes to you or the charity. Subscriptions for general charitable purposes and those to for. Are political donations tax deductible uk Are Donations to Political Campaigns Tax Deductible.

S341 Income Tax Trading and Other Income Act 2005 S541 Corporation Tax Act 2009. Political donations made by individuals are not tax-deductible in Britain. However there are still ways to donate and plenty of people have been taking advantage of them over the past several years.

Reuters is the first to measure the loophole which offers political parties and in some cases individual politicians or their families an unintended gift from the taxpayer. However in-kind donations of goods to qualified charities can be deductible in the same way as cash donations. The federal government allows various deductions that can help reduce your taxes but this does not include your political contributions to the campaigns of any organization or.

Although political contributions are not tax-deductible there is always a limit to the amount that can be contributed to a political campaign. The same goes for campaign contributions. The answer is no donations to political candidates are not tax deductible on your personal or business tax return.

Individuals can contribute up to 2800 per election to the campaign committee up to 5000 per year for PAC and up to 10000 per year for local or district. 75 percent of the original 200 50 percent of the next 900 and 33 percent of the next 1200 are capped at 1000 per participant. However there are still ways to donate and plenty of people have been taking advantage of.

The united kingdom parliamentary expenses scandal was a major political scandal that emerged in 2009 concerning expenses claims made by members of the british parliament in both the. If you are not tax exempt and contributed charitable donations to a qualified organization you could claim a tax deduction. If a donor makes money as salary or dividend and then donates it they have to pay income tax.

Things To Know. To be allowable for tax purposes expenses must be incurred wholly and exclusively for the purpose of the trade. Donations by individuals to charity or to community amateur sports clubs CASCs are tax free.

This paper then considers options for making tax deductions for donations.

Tax Deductible Donations Can You Write Off Charitable Donations

Common Tax Issues Associated With Making Donations Wolters Kluwer

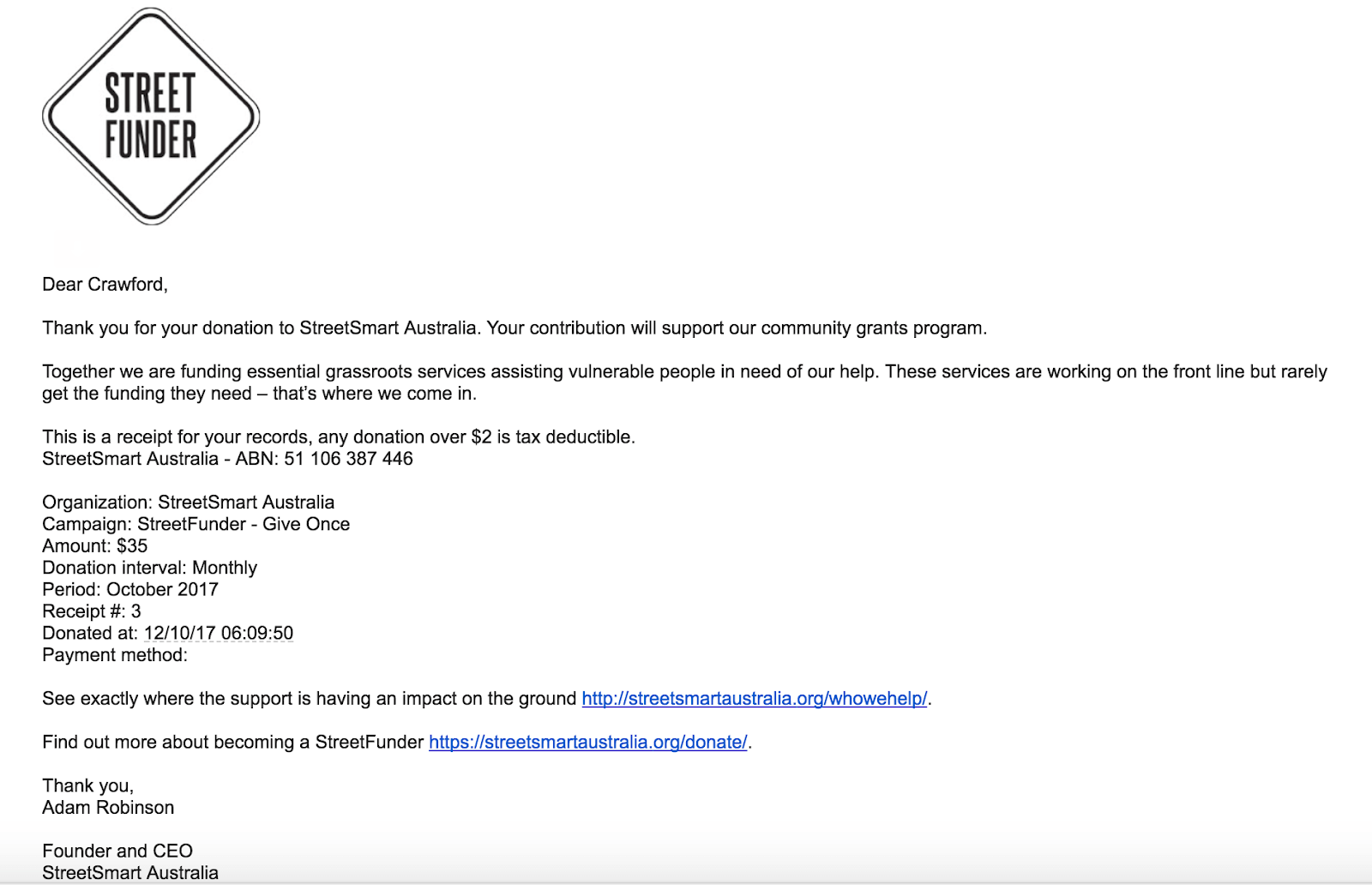

Complete Guide To Donation Receipts For Nonprofits

New Tax Regime Disincentivises Charity Donations Says Study Business Standard News

Understanding Tax Deductions For Charitable Donations

Nonprofit Tax Programs Around The World Eu Uk Us

Complete Guide To Donation Receipts For Nonprofits

Tax Deductions For Donations In Europe Whydonate

Full Article Can The Deferred Donation Deduction Policy Promote Corporate Charitable Donations Empirical Evidence From China

Deductible Or Not A Tax Guide A 1040 Com A File Your Taxes Online Business Tax Tax Write Offs Business Bookeeping

Canadian Tax Return Check List Via H R Block Ca Http Www Hrblock Ca Documents Tax Return Do Small Business Tax Deductions Business Tax Tax Prep Checklist

Difference Between Charity Business Administration Think Tank

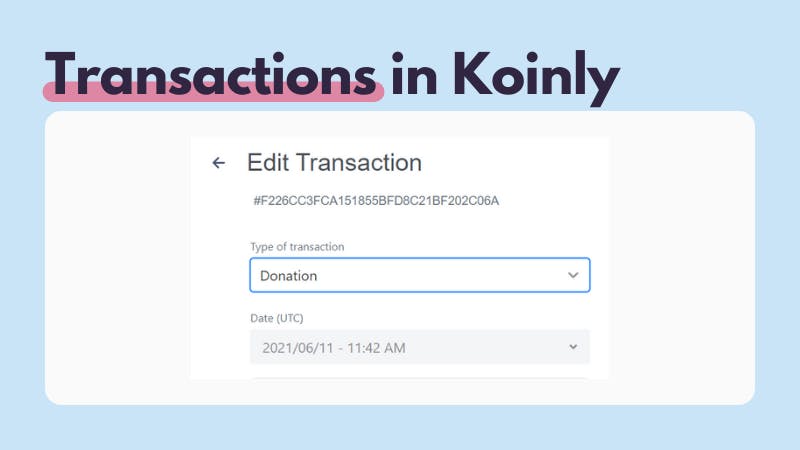

Donate Crypto And Lower Your Tax Bill Koinly

How Much Should You Donate To Charity District Capital

Donate Crypto And Lower Your Tax Bill Koinly

5 Donation Receipt Templates Free To Use For Any Charitable Gift Lovetoknow

Complete Guide To Donation Receipts For Nonprofits

Tnt Post S Infographic Our Donations What Who And Why Infografia Solidaridad

/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)